Successful small business owners almost always have a passion for their products or industry. They almost always have natural business savvy, confidence, and work ethic to succeed. But not all of them have a background in finance. So without a CFO or an accountant on staff, how do they manage small business finances? How much time do they spend on statements? Are they tracking cash flow, revenue, and expense reports?

RELATED: Only 55% of Small Business Owners Would Recommend Their Banking Partner to a Peer

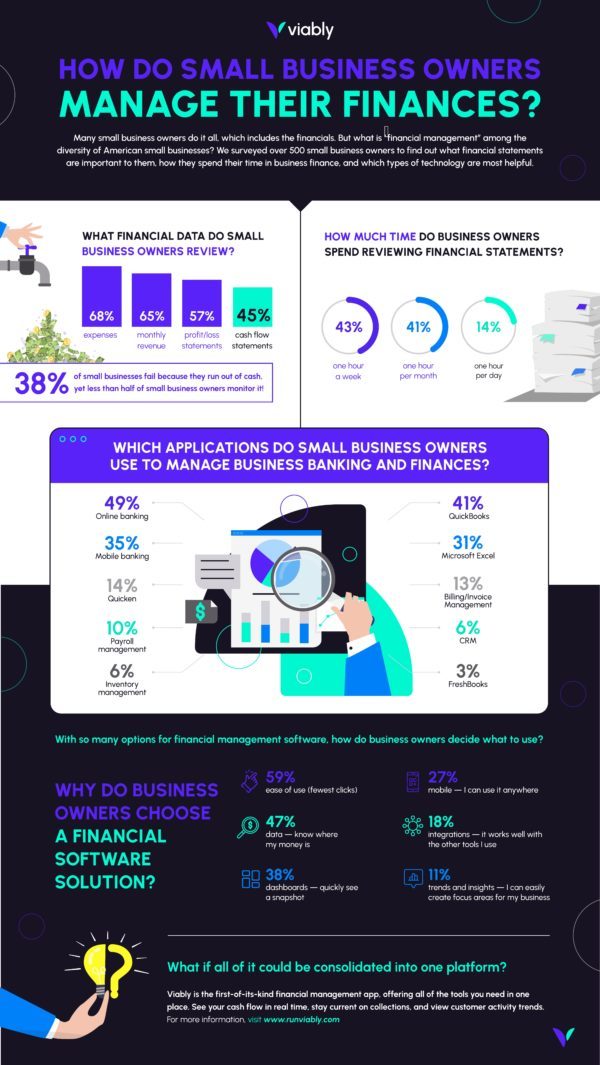

We asked 500 small business owners about their financial management habits. Here’s what they said:

Less than half of small business owners monitor cash flow

One of the most important pieces of business finance is simply tracking the right data. With that in mind, we asked small business owners which financial data points they review. Here are the most popular answers:

- Expenses (68%)

- Monthly Revenue (65%)

- Profit/Loss Statements (57%)

- Cash Flow Statements (45%)

While it’s not the most exciting part of owning a business, these data points are all critical indicators of business financial health. Considering 38% of small businesses fail because they run out of cash, the cash flow number should be much higher.

The ability to track key financial data in real-time is clearly a gap for small business owners, so how are they trying to address it?

Technology and applications for small business financial data can be helpful. Small business owners don’t have time to write cash flow statements and manually fill out spreadsheets of expense data. It used to be a necessary evil, but there are other options now.

According to our survey, here are the most popular types of technology and applications for small business banking and finances:

- Online Banking (49%)

- QuickBooks (41%)

- Mobile Banking (35%)

- Excel Spreadsheets (31%)

- Quicken (14%)

- Billing/Invoicing Software (13%)

- Payroll Software (10%)

There were a number of tools that received fewer responses, but the bottom line is, there are a lot of choices. Small business owners overwhelmingly cited ease of use (59%) as the most popular reason to choose a technology solution.

Many of these tools are addressing singular financial challenges for small business owners.

“How do I invoice?”

“How do I manage my bank accounts and credit cards?”

“Where do I find financial statements for tax purposes?”

“How do I ensure my employees get paid?”

This creates the possibility of having too many data platforms for small business owners to track everything. This leaves us back where we started, with small business owners struggling to stay current on the data that matters most.

Find an All-in-One solution

All of those individual solutions above are good things for small business owners to have. But none of them will provide real-time cash flow updates, insights on their business performance, and recommendations to optimize.

However you bank, send invoices, or pay your employees, you need a place to see how everything contributes to the overall financial health of your business. More specifically, you need to see real-time impact on your bottom line and cash flow.

This way, small business owners can find opportunities to trim wasteful spending, optimize their invoice collections, and prepare for future growth or operations with enough cash on hand.

Learn how an all-in-one platform for banking, insights, and financial management might help your small business manage cash flow.