There’s a saying that goes, “Revenue is vanity, profit is sanity, but cash is king.” If cash is king, why then, do 82% of small businesses go broke due to cash flow issues?

Viably’s December 2021 survey of small business owners found that:

Many small business owners focus on revenue and profit but lack a clear understanding of the importance of cash flow to the long-term viability of their company.

We’ve written this guide to help small business owners better understand cash flow management and its impact on their decision-making. Below, you’ll learn why cash flow is so important, how to calculate and project it, how to improve cash flow, and how to avoid some common cash flow management mistakes that businesses make.

Small business owners must understand what the “flow” of cash means. Cash flow refers to the total amount of money flowing into and out of a business over time. Money that a small business receives is a cash inflow, while cash that leaves the business is a cash outflow.

Cash flow essentially boils down to sources of funds vs. uses of funds—the money coming into a business vs. the money going out. Cash inflows are derived from sources of funds. Sources of cash include revenue from product and service sales, loan proceeds, investment capital, and grant money. Uses of funds drive cash outflows and include materials purchases, operational expenses, salary payments, interest payments, asset purchases, and dividends paid.

The combination of sources and uses of funds at a given moment determines whether you have a surplus of cash that can be used for future operations and opportunities, or a deficit of cash, which means you are unable to operate without finding more cash.

For cash flow management and reporting, cash flows are divided into three types: operations, investments, and financing. Cash flows from operating activities occur as a result of business operations and daily operations, such as purchasing inventory or paying utilities. Investment cash flows are those related to long-term assets, such as equipment purchases or property sales. Financing cash flows result from debt and equity, including debt and interest payments to creditors and dividends paid to shareholders. Below are examples of different types of small business cash flows.

| Operating Cash Flows | Investing Cash Flows | Financing Cash Flows |

|---|---|---|

| Revenues and royalties | Equipment purchases/sales | Loan proceeds/repayments |

| Salaries and commissions paid | Acquisition of new business or product line | Credit card debt/repayment |

| Cash paid to suppliers | Property purchase/sale | Capital lease payments |

| Income tax paid/refunded | Purchase/sale of stocks/equity | Dividends paid/received |

| Rent and utilities | Other fixed asset purchases | Employee stock options/purchase |

Business owners often fall into the trap of believing that as long as they are showing a profit on their books, there will be enough cash to fund ongoing operations. Even profitable small businesses can run out of cash. Profit, like cash flow, is either negative (a net loss) or positive (a net profit), but that does not mean that cash flow and profit are the same. If a small business owner understands the relationship between cash and profit they can more easily make key decisions such as how to pursue new opportunities or how to adjust to changes in the market.

Even profitable small businesses can run out of cash.

Profit is a financial accounting term that refers to the balance left on the business books after operating expenses are subtracted from revenue. Profit is calculated using accrual accounting methods, which means that revenue and expenses are recognized on the books at a different time than the timing of cash flows related to those ledger items. In addition, profit calculations include “non-cash” expenses such as depreciation and write-offs.

Cash flow reflects the current reality of a small business’ bank account. It indicates the net flow of actual cash into and out of a business by accounting for all sources and uses of funds up to a point in time. Therefore, profit is just part of a company’s cash flow but does not tell the entire story.

For example, if a business sells a product to a customer who has 30 days to pay, the revenue from the sale and the cost to produce the product is recognized immediately on the profit and loss (income) statement. However, it may take 30 days on average (assuming the customer pays on time) for the cash inflow from the customer’s payment to appear in the business bank account, and the funds associated with the production of the product, such as materials and labor, have already left the business. Even though the business has booked a profit on the sale of that product, it has already spent the money to create it and has not yet received the cash for the sale.

As a result, you have a cash flow gap. Ongoing and increasing cash flow gaps are what cause small businesses to go broke

Small businesses often have difficulty generating and holding onto the cash they need to fund continuous prolonged business operations. Many small businesses fail due to an ongoing lack of cash flow. To understand why cash flow management is so important to small businesses, it’s important to understand three financial concepts: liquidity, solvency, and viability.

A small business’ liquidity refers to its ability to meet its short-term financial obligations at any moment. Essentially, liquidity refers to the ability of a business to convert its assets to cash quickly. Cash is the most liquid asset, followed by short-term receivables. An illiquid asset would be equipment or a building.

Solvency refers to a state where assets (inventory, receivables, equipment, etc.) of the company are sufficient to cover its long-term liabilities (term loans, taxes, interest due, etc.). The cycle of cash inflows and outflows over time and the gap between the two determine a small business’ solvency. When a business’s assets become illiquid, it is unable to generate enough cash to meet its long-term financial obligations. Therefore, it may not be able to borrow or raise funds for future operations and obligations. This state eventually leads to insolvency. At that point, it is no longer a viable business.

Therefore, small business owners need to understand the liquidity of their business at all times. They should understand how many months of cash flow their business can easily generate before it runs out of cash and becomes insolvent. Good cash flow management allows you to run your business viably, that is to say, in a way that generates sufficient cash flows year after year.

The timing of inflows of cash from sales and payments and outflows needed to meet financial obligations affect the small business’ ability to conduct daily activities. On any given day, a small business’s cash flow position determines whether it can pay its employees, pay its vendors, take on new orders, or offer its customers incentives and discounts. Cash flow ultimately affects a business owner’s ability to make key day-to-day decisions, plan for growth, and to react to market changes.

To this effect, a small business’ growth trajectory is heavily impacted by its ability to generate cash and to have an accurate accounting of its cash position. Growth requires upfront cash to purchase fixed assets and materials or hire employees. A business owner may not be able to deliver on new orders and growing demand without sufficient current and future cash flows. Take seasonal businesses, for example.. A business owner can’t expand sales to meet seasonal demand without sufficient cash to finance the purchase of materials or inventory, and to pay for labor and additional production costs ahead of peak demand. If the business doesn’t have the cash, it won’t have enough product and cannot optimize sales during its greatest opportunity of the year.

Cash flow and growth present a conundrum in that a small business typically must demonstrate both growth and positive cash flow to appear creditworthy to a bank. Yet, the business may need bank funds to support business growth. Unless a company has enough cash flow to fund some growth on its own, it may be unable to secure additional funds from a lender to accelerate its growth. Further, if a business doesn’t have enough cash flow to cover current obligations, it won’t be able to obtain credit. Without access to credit, the business will have difficulty growing. Therefore, generating sufficient cash flow from daily operations and managing those cash flows well are critical to supporting future growth.

Cash flow determines the stability of a small business in the end. The cash flow of small businesses needs to be sufficient to cover everyday operations, handle unexpected expenses, fund growth opportunities, or adjust to other business irregularities. Without a sufficient buffer of cash, any of these factors could result in a cash flow gap.

How do you know how much cash you have at a given time? What about the cash you need to operate and grow your small business? Cash flow management involves tracking how much money is coming in and out of a business over time. Cash flow management tools and techniques enable business owners to predict and manage how much money will be available to the business in the future. Good cash flow management is key to success for small businesses.

Three cash flow management techniques help small business owners understand, manage, and improve business cash flows:

We’ll cover all three in detail below, including how to prepare a cash flow statement, how to create a cash budget, and how to prepare a cash flow analysis.

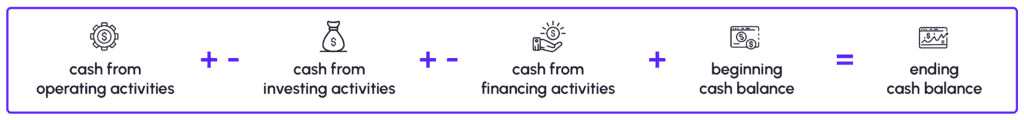

Before using any of the three cash flow management techniques, you need to know how cash flow is calculated. The most common method of calculating a small business’s cash flow breaks cash flow balances into the three categories and adds them to the cash balance at the beginning of the period. That formula for any time period is:

In this formula operating cash flow (OCF) is the most important component. Cash flow from operating activities indicates how successful the day-to-day operations are by calculating how much cash is generated through normal business operations. OCF typically determines a business’s profitability and viability. Here is the formula for OCF:

The statement of cash flows is one of three financial statements that a small business must prepare at the end of each accounting period. The other two financial statements are the income (P&L) statement and the balance sheet. The cash flow statement is the single most valuable tool a small business owner has for managing liquidity and solvency over time.

The statement of cash flows breaks down small business cash flows into the three types mentioned above: operating, investing, and financing cash flows. It documents the money that flows into and out of the business, measures the changes in cash related to assets and liability accounts over a period, and calculates the business’s net cash position at any given point in time.

The operating cash flow statement shows the increases and decreases in the current asset and current liability accounts over the period. Investment cash flows show the net cash generated from investing activities. Financing cash flows show the result of funding going into the business or the repayment of funding. A cash flow statement serves many valuable purposes. It helps identify any cash flow challenges and potential gaps between money coming in and money that needs to go out in the future. It can help business owners understand how to increase profit margins and can help identify costs that are negatively impacting the business. Additionally, the process of creating a cash flow statement might reveal funds that are unaccounted for, trends in different businesses or product areas, customer problems, or areas for future growth and investment.

There are two methods available for preparing a small business cash flow statement: direct and indirect. The difference between the two methods is in how operating cash flow is derived. That said, net cash from operating activities and the final cash balance will be the same using either approach. Both methods have advantages and disadvantages. Regardless of which method you choose, you will need your income statement and balance sheet for the same period to calculate your cash flow position.

Direct Method

The direct method of producing a cash flow statement is based on cash accounting methods. Cash flow from the operations of a company is calculated based on actual cash inflows and outflows. Every single direct source and use of cash funds, such as cash paid by customers, cash paid to employees, interest paid, and so on, is listed on the cash flow statement using the direct method. Due to the level of detail this method of preparing a cash flow statement provides, the Financial Accounting Standards Board (FASB) recommends that companies use this method.

One of the main advantages of the direct method is that the cash flow statement can be read easily because it separates transactions into just two types: positive cash flow and negative cash flow. The level of detail provided is also helpful to investors and creditors in understanding the economics of the business, and it gives small business owners a precise view of where the company’s funds came from and how they were spent. The main disadvantage of using the direct method is that it takes time to prepare the cash flow statement in this way. Many small businesses don’t keep track of their cash in the detail required by the direct method.

Indirect Method

The general steps for the indirect method are:

Since most small businesses use accrual accounting and have a P&L and balance sheet to use, the indirect method is generally accepted as the easiest method of creating a cash flow statement because it is more quickly done than the direct method.

Although it may seem intimidating to some small business owners to calculate cash flow using either method, cash flow statements can be easily created using a basic spreadsheet template. Here is an example of the most commonly used method of calculating cash flow, the indirect method.

| Ledger Item | Change During the Period | Explanation |

|---|---|---|

| Net Income before dividends | $500,000 | Taken from the P&L statement |

| Adjustment for depreciation of fixed assets | $15,000 | Depreciation is a non-cash expense deducted from net income. |

| (Increase)/decrease in current assets (working capital) | An increase in current assets is a use of funds; a decrease is a source. | |

| Accounts receivable decrease | $25,000 | A decrease in receivables is a source of funds. |

| Inventory increase | (225,000) | An increase in inventory is a use of funds. |

| Prepaid expenses | ($25,000) | Prepaying expenses such as rent and insurance is a use of funds. |

| Increase/(decrease) in current liabilities | Taken from changes in balance sheet accounts | |

| Increase in accounts payable | $30,000 | An increase in payables is a source of funds. |

| Decrease in wages payable | ($35,000) | Wages were paid out. |

| Other accrued expenses | $2,000 | An increase in unpaid accruals is a source of funds. |

| Net Cash from Operating Activities | $287,000 | CFO should be the same whether it is derived from the direct or indirect method. |

| Cash Flow from Investing | Cash from the sale or purchase of property, plant, and equipment. | |

| Equipment Purchase/Lease | ($25,000) | This could include an outright purchase or capital lease payments on equipment. |

| Cash Flow from Financing | Increases/(Decreases) in balance sheet liabilities | |

| Line of Credit | ($75,000) | drawdown/(repayment) |

| Term loan | $5,000 | Loan proceeds |

| Owner Draw | ($20,000) | Sum paid out to owner in lieu of salary |

| Net Increase/(Decrease) in Cash | 172,000 | Sum of all operating, investing, and financing cash flows. |

| Beginning Cash Balance | $80,000 | Add net change in cash to starting cash balance for the period. |

| Ending Cash Balance | $252,000 |

| Ledger Item | Cash Paid/Received During the Period | Explanation |

|---|---|---|

| Cash receipts from customers | $ 450,000 | total sales minus the increase in receivables, or plus a decrease in receivables |

| Less Cash Paid For: | From cash records or calculated from P&L and balance sheet reports | |

| Purchase of inventory and materials | ($80,000) | cost of goods sold plus inventory increase/(decrease) plus account payable decrease/(increase) |

| Wages | ($10,200) | wage expense from P&L, plus the decrease in wages payable, or minus increase in wages payable |

| Utilities and Rent | ($11,000) | calculated similarly to salary expense |

| Advertising expenses | ($5000) | calculated similarly to salary expense |

| Other operating expenses | ($32,000) | calculated similarly to salary expense |

| Taxes | ($90,000) | calculated similarly to salary expense |

| Interest | ($20,000) | Interest paid on debt during current operating period |

| Cash flow from operating activities | $201,800 | |

| Cash Flows from Investing Activities | ||

| Sale of machinery | 8,000 | Decrease in fixed assets on balance sheet plus gain recorded on income statement |

| Cash Flows from Financing Activities | ||

| Loan repayment | ($5,300) | Decrease in long-term debt on the balance sheet |

| Net increase/(decrease) in cash | $204,500 | |

| Cash Balance at Beginning of the Period | $48,000 | |

| Cash Balance at End of Period | $252,500 |

The Small Business Administration recommends using a 12 month cash flow statement using the direct method.

It’s not enough to create a cash flow statement and understand your current cash position. One reason so many small businesses run out of cash is that they do not forecast and budget for future cash needs. A cash flow projection is a forecasting tool that includes a breakdown of sources and uses of cash in a future period. Predicting changes in cash flow using the current cash flow statement as a basis allows business owners to anticipate changes in cash, make decisions, and budget accordingly.

As a rule of thumb, small businesses should create cash flow projections on a monthly rolling basis, forecasting 12 months out. To improve cash flow forecasting accuracy, projections should be updated weekly with actual sources and uses of funds. To create a cash flow projection, use your current cash flow as the starting basis. You can also use the prior year’s numbers for any given period (e.g., month) as a basis of cash flow for a future period. Adjust the basis for anticipated changes such as new products or services, price changes, employee changes, loan payoffs, and so forth, over time. Over the 12-month period, the cash flow projection should be updated to reflect developments in expenses and income.

By conducting regular detailed cash flow projections the sustainability of operations can be planned for and executed in a way that maintains business stability and ensures that cash is available for controlled growth. In this regard, small business cash flow projections are one of the most important business planning tools to ensure business viability.

This can be a lot to manage for a business owner, especially if there are no trained financial professionals on staff. Consider a tool that can track and project cash flow in real-time, so this information is always at your disposal.

Another tool for small business cash flow management is a cash budget. One study of small business cash flow management found that 50% of small businesses had less than 15 days of cash buffer and only 40% had more than a three-week buffer. These statistics indicate that the majority of small businesses maintain a thin cash buffer.

One way to improve the cash buffer is to create a monthly cash budget that relates to your cash flow projections and anticipates cash needs. By understanding projected cash flows, business owners can set aside the cash they will need for expenses and can manage business activities accordingly. As with cash projections, a cash budget should be created 6-12 months in advance and adjustments made as needed based on actuals.

In addition to being a cash flow management tool, cash budgets can serve as a small business management tool to explore and plan for future business scenarios. For example, a business owner could look at the impact on the budget of changing the speed of payment collections through invoice factoring or examine the impact of equipment leasing. This technique allows business owners to predict the outcome of a business decision or potential situation that impacts cash flow and plan accordingly.

One final benefit of creating cash budgets is increased accuracy. Few small businesses have very regular cash flow patterns. Over time, by comparing budgeted cash flows to actual cash flows a small business can improve cash flow forecasting techniques.

Cash flow analysis is the third tool of small business cash flow management. This technique involves examining the components of a business that affect its cash flow, such as accounts receivable, inventory, accounts payable, and credit facilities. The purpose of cash flow analysis is to identify cash flow problems that impact liquidity and solvency and to help find ways to improve cash flow.

A cash flow analysis involves calculating several different ratios that provide insight into the reasons for positive or negative cash flows. These ratios are used to compare cash flow to other elements of a company’s financial statements.

The table below lists common ratios used and their formula, and provides a brief explanation of each ratio’s purpose.

| Ratio | Formula | Explanation |

|---|---|---|

| Current Liability Coverage Ratio | cash flow from operations – dividends (or owner draw)

÷ by average current liabilities | A measure of liquidity that indicates the ability of business operations to cover short-term debts. A ratio less than 1.0 indicates a business is experiencing a liquidity problem. The higher the ratio, the more liquid the business is. |

| Operating Cash Flow Ratio | cash flow from operations

÷ by average current liabilities | Determines the amount of cash generated by basic business operations to ensure overall liquidity. A ratio of < 1.0 indicates a cash crisis. |

| Cash Flow Margin Ratio | cash flow from operations ÷ sales | Indicates how much cash is generated per dollar of sales and is generally a better indicator of financial health than gross margin. |

| Cash Interest Coverage Ratio | earnings before interest and tax ÷ interest payments during the period | Measures the business’s ability to meet interest payments on debt. If the ratio is < 1.0 the business cannot meet interest obligations. |

| Cash Flow Coverage Ratio | cash flow from operations ÷ (total debt + interest) | Measures solvency and indicates whether a company can pay total debt obligations. A ratio < 1.0 indicates a danger of insolvency. |

| Debt to Asset Ratio | total liabilities ÷ total assets | A solvency ratio that measures the total amount of business assets that are funded by debt. |

An owner of a business can gain insights into potential liquidity issues by performing a periodic cash flow analysis. A decreasing current liabilities coverage ratio, for example, indicates the business needs to focus more on receivables collection, discount inventory for a quick sale, or delay future inventory and materials purchases. In addition, by monitoring liquidity and solvency ratios it is easier to obtain funding from creditors who will do this type of analysis when deciding whether or not to offer credit facilities.

Small businesses often let inventory sit on shelves. A healthy cash flow depends on the turnover of inventory for which the cash outlay has already been incurred. Identify industry norms for inventory turnover and discount any inventory that exceeds that average or bundle with other products and services to move them off your balance sheet.

There are many ways to collect payments from customers more quickly. Utilizing technology that enables you to receive payments sooner, encouraging credit card payments, providing discounts and incentives for early payment, and ensuring that invoices are sent early, are accurate, and have clear deadlines are all strategies. Consider performing credit checks on potential customers or requiring deposits to reduce receivables write-off risk.

The relationship you have with vendors and suppliers is the most important factor in managing accounts payables. To generate credibility with vendors and reduce expenses, pay invoices on time and take advantage of early payment discounts. Try to negotiate better payment terms. For example, you might sign long-term contracts in exchange for lower prices.

If hiring a bookkeeper is too expensive, or even if you already have one, software that tracks receivables and payables, generates invoices, pays bills, and generates cash flow statements and other cash-related reports can enhance your small business cash flow management. Not only will technology save you time, but it will also save you money by providing you with the tools to better understand and manage cash flow.

A cash crunch is not the right time to learn what options you have to close the cash flow gap. Educate yourself on temporary funding options ahead of time. Consult your bank about solutions such as a revolving line of credit, and monitor your credit score so that you will have access to funding when you need it.

Consider flexible ways to finance long-term and capital-intensive assets such as equipment and facilities. Furthermore, depending on the market and the stability of your business, you may be better off purchasing real estate and making mortgage payments than being locked into a long-term lease.

Maintain a mentality that, as much as possible, your business should generate the operating cash flow it needs to cover its obligations over time. Imagine that debt is not an option and make cash decisions accordingly.

It is often difficult to identify routines and processes that inhibit cash flow in the day-to-day management of a small business. Technology is often the answer to increasing productivity. You should look for redundant and manual tasks that could be automated or eliminated to allow employees to focus on cash flow-generating tasks. An excellent example of this is empowering salespeople with data and technology to close deals more quickly and easily.

In the first year of a small business, owners may not know what to charge for their products or services, so the tendency is to keep prices low to ensure that customers come. Understand the true value of what you’re offering your customers. Benchmark against competitors and industry standards. Test the market and adjust prices as necessary. As an example, a coffee shop could raise the price of one or two high-demand products to see how that impacts sales.

Accepting credit card payments increases cash flow on the customer side. On the business payment side, you can utilize business credit card float time and cash-back or other rewards. Small business owners can also take advantage of early payment discounts with vendors by paying with a credit card.

Despite the importance of having cash, having too much cash on hand can be detrimental to your small business, as ironic as that sounds. Recognizing and funding opportunities for re-investment and growth is essential, as well as utilizing cash efficiently so that it generates a profit. If the company does not grow or demonstrate productive uses of cash, access to capital may be limited and the business’ excess cash may be used up over time to maintain the business.

When small business owners expect rapid growth or see an increase in demand, they commit to cash expenditures such as hiring labor, purchasing raw materials and inventory, or spending on marketing without thinking about the timeline for product and sales revenue and subsequent cash flow. Delays or unexpected changes in demand could cause a cash crunch.

Some small business owners equate sales growth or revenue booked with cash flow sufficiency. Often, growing companies experience tight cash flow since they must hire more labor and produce more products before they can collect cash from sales. In many cases, there can be months between the cash outlay to ramp up production and the collection of product sales.

Even if your business qualifies for credit facilities or is attractive to investors, applying for loans and raising funds is a time-consuming process that can interfere with managing the business, especially in crisis situations. It’s much better to manage the funds your business has already generated or borrowed efficiently rather than constantly looking for additional funding.

Cash flow projections and management can be complicated. There are many small businesses whose owners are overburdened, preferring to focus on managing the day-to-day operations or developing the business instead of tracking cash flow and analyzing ratios. A CEO may be tempted to believe that monitoring and managing cash flow is the responsibility of an accountant or bookkeeper. Details can be left to these experts, but a poor understanding of cash flow will make it difficult to make good business decisions, and a lack of cash flow management skills could put the company at risk.

Small businesses need to manage cash flow strategically to survive and grow. The chances of a small business remaining viable dramatically increase when the business owner takes the time to understand, plan, and predict cash flows each month. Good cash management means small business owners are aware of their cash flows at all times and use cash flow tools to understand the current and future state of the business. A small business with strong cash management processes has many advantages. It can fund its operations effectively, acquire customers, negotiate optimal terms with vendors and creditors, and react strategically to market changes over the long-term. So the bottom line is: Don’t run out of cash, run Viably!

Viably Capital Inc. is a financial technology company, not a bank. Some Viably Banking® services are provided by Piermont Bank, Member FDIC.* Viably Payments® services for U.S. customers are provided through Airwallex US, LLC (NMLS #1928093). Airwallex is licensed or authorized to do business as a money transmitter in most states. For some U.S. customers, Airwallex partners with Evolve Bank & Trust (member FDIC) to provide payments services. The Viably Mastercard® debit card is issued by Piermont Bank pursuant to a license by Mastercard International Incorporated and may be used anywhere Mastercard debit cards are accepted. The Viably Visa® debit card is issued by CFSB and may be used anywhere Visa debit cards are accepted. Applications for Viably Banking® and Viably Payments® services are subject to approval. Terms and Conditions for Viably Banking® and Viably Payments® services apply and are subject to change. No application or monthly fee. Some fees and limits may apply.

Viably Growth Capital and Viably Cash Advance products are offered solely through Viably and are not part of the Viably Banking® or Viably Payments® Services provided by Piermont Bank and Airwallex, respectively.

* The funds in your account held at Piermont Bank are FDIC insured up to $250,000 per depositor for each ownership category.

©2024 VIABLY. All rights reserved. Viably®, Viably Banking® and Viably Payments® are registered trademarks of Viably Capital, Inc.