Successful Amazon sellers have many skills in common. For instance, most are excellent problem solvers. We also struggle with many of the same things, such as cash flow and forecasting.

One of the primary opportunities for growth for most sellers is to launch new products. Let’s assume you’re very good at researching and sourcing products. You still need to map your inventory and expenses against your available cash to execute a successful launch. But here are a few truths about cash flow and Amazon sellers:

-

- Most Amazon sellers don’t have cash flow.

- Most Amazon sellers don’t understand cash flow.

- Most Amazon sellers don’t know how to improve their cash flow.

In this post, I’ll help you avoid falling into any of those categories. Let’s get started.

Why is cash flow so hard?

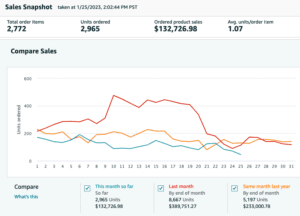

Most Amazon sellers can tell you everything about sales and traffic for every listing, how their product sales are broken down by ASIN, return rates, review rates—basically anything to do with performance once the product is listed. All of this is readily available in your Amazon Seller Central account, and all of it is useful. But it doesn’t tell you what you’re spending, when the revenue will hit your account, and how much cash your business has (or will have in the future).

Simply put: Amazon is great at showing revenue. It’s not great at showing profit, and it’s even worse at showing cash flow.

As a result, you might (or might not) piece together P&L statements and cash flow statements with an accountant, through QuickBooks, or in a spreadsheet. And most likely, you don’t have any projections. Unfortunately, many Amazon sellers (even successful ones) are simply guessing how much they can afford to budget for their goals.

Here’s a better option. Connect your sales data from Amazon Seller Central with your banking and expense data in one dashboard. Not only will you see seasonal trends, but you can also plan your investments according to cash projections.

Now, let’s talk about the impact cash flow has on your business, and how your decisions affect your cash flow.

How to think about cash flow

In order to maximize your ability to invest in growth, you need to have as much cash in your bank account as possible. But here’s the important thing to remember:

Cash flow is not equal to profit. To illustrate this in simple terms, here’s a comparison I use in my book.

The 12 rows represent each month of the year, and we project our expenses and revenue from a product launch. In each case, we start with $15,000 cash and launch the product with a $10,000 order from our supplier. In each case, we pay our supplier a 30% down payment in the first month. By the time the product is produced, shipped, delivered to a fulfillment center, and sold—we’ve already hit month 4 by the time we start to get paid.

But notice the differences in these two product launches. In Example 1, we pay for the entire order immediately. Our available cash is already down to $5,000 before our first revenue from Amazon. In example 2, we’ve spaced out our inventory into three separate orders. As the first shipment starts to sell, the second shipment arrives, and so on. We net the exact same income and profit in both examples, but why is example 2 so much better for our business?

In example 2, our cash flow remains much healthier throughout the cycle, which means we can invest that cash in other product launches. If you adopt this approach during simultaneous product launches, imagine how much more you can afford to grow.

This is how you should think about cash flow for your Amazon business: How can you maximize your available cash for growth opportunities?

Tips to improve your cash flow

In the example, I granted us the luxury of $15,000 available cash to launch a product. You might not have that luxury, and you’re not alone. Amazon is a cash-tight business. Perhaps your cash is tied up in inventory, and you’re in the perpetual cycle of waiting for Amazon to release your sales revenue. You’ll need to be creative and relentless to free up cash, even if your business is thriving.

Here are some things you can do to start building a healthy cash reserve:

Fund your growth

When you have a healthy sales history (at least one full year of revenue growth), you’re likely eligible for funding. There’s nothing wrong with a healthy amount of debt in your growth plan. For many Amazon sellers, this is the best or only way to afford the investments with real payoff.

Imagine I borrowed the $15,000 from the chart above. If I follow Example 2, I can easily keep up with almost any repayment structure. As long as my APR or working capital fee is reasonable, I will still turn a significant profit at the end of the year. Funding allows me to scale this model for more simultaneous product launches or larger orders of inventory. This is how I’ll start to double and triple my revenue.

Explore your options. Find the best rate and repayment structure. And most importantly, forecast your cash flow and investments according to this influx of capital.

Order small quantities, more frequently

The only difference in strategy for each of the examples above is the size and timing of my orders. Ordering smaller quantities improves your cash flow by stretching your expenses.

It also gives you more flexibility for inventory management because you can react to sales performance. If the product sells slower than anticipated at launch, you can adjust your listing or PPC campaigns without spending your entire budget on inventory sitting in a warehouse. If the product sells quickly, you can adjust pricing and/or purchase more inventory.

The only scenario in which I would advise paying up front for large orders is if you can negotiate a significant discount. In this case, you should consider paying with borrowed capital to avoid tying up all your cash. Especially if you’re planning to exit your business.

Plan for success

Obviously, failed launches can be expensive. But in the short term, successful launches are even more expensive. That might seem counterintuitive, but consider this:

What happens when your first order starts to sell as planned? Do you have enough cash to start ordering more before you get paid?

If not, you have a cash flow issue that can lead to the dreaded stockout. A successful launch requires you to pay for multiple orders, and to support those orders with marketing campaigns to gain momentum for your listing.

Launching a product is not just about the first month of a new listing; it’s about establishing another reliable income stream for your business. That means you need cash to invest in sustaining momentum beyond the first 30 days.

And my last tip: simulate your cash flow for all of your growth possibilities. Input dates and amounts for your expenses such as inventory payments, marketing campaigns, packaging, shipping, etc. Estimate the revenue you’ll generate (and when you’ll have the money). Add and subtract products or move launch dates in order to optimize your cash flow – and consider filling the gaps with funding.

The best thing you can do for your cash flow (and business growth) this year is to plan.